When & how will I receive the fees paid by my students?

We follow a 'T + 1' settlement cycle, meaning the payment will be settled into your bank account in 2 working days from the successful transaction date. This is the same bank account details of which were provided in your KYC documents.

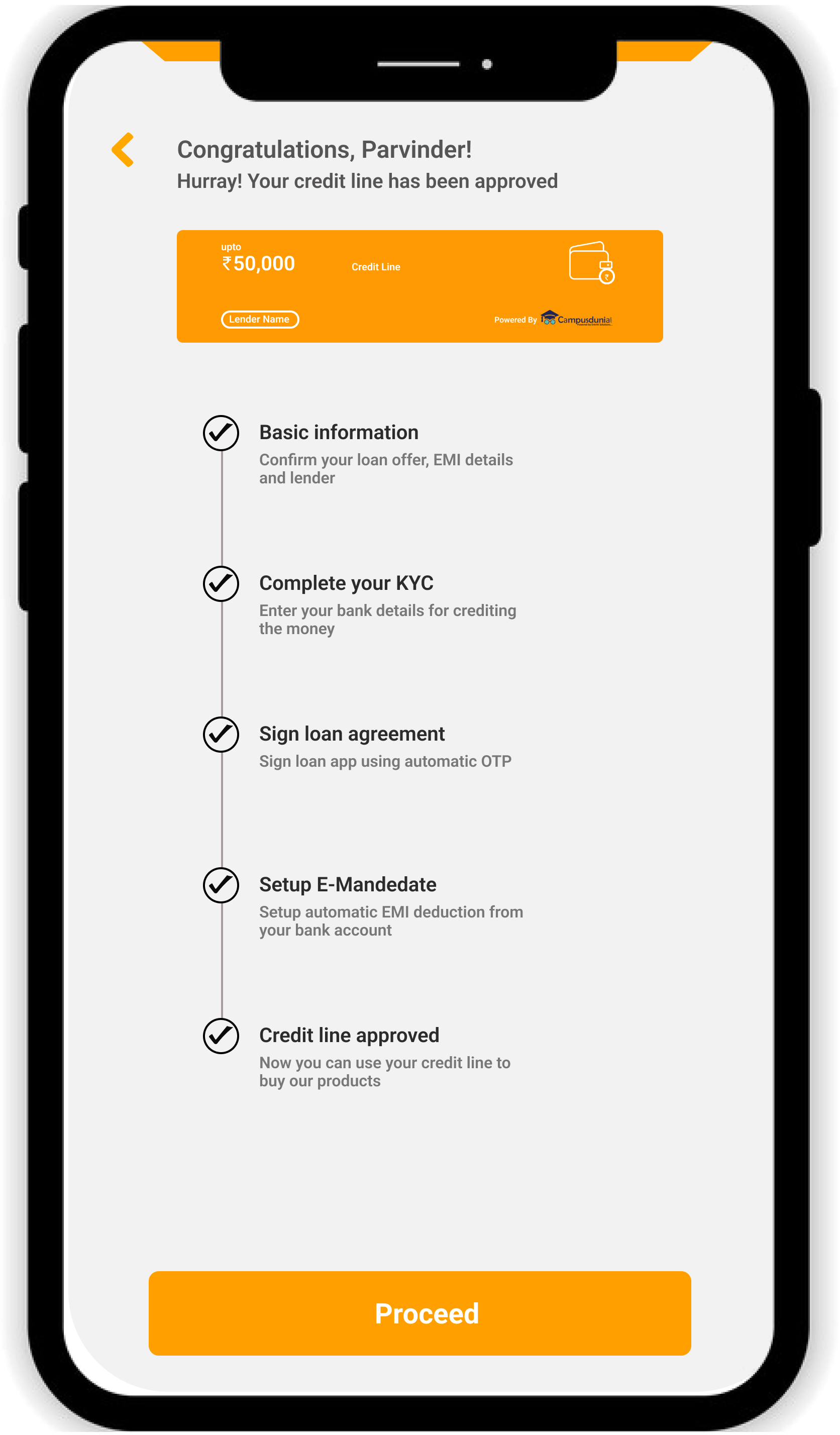

What are KYC documents and why is it required to be submitted?

Generally an identity proof with photograph and an address proof are the two basic mandatory KYC documents that are required to establish one's identity.

For KYC, one needs to upload copies of PAN Card, Aadhar Card & a Cancelled Cheque (without signature).

The objective of KYC guidelines is to prevent businesses from being used by criminal elements for money laundering activities. It also enables businesses to understand their customers, their financial dealings so as to serve them better and manage its risks prudently.

What if I do not submit KYC documents?

For KYC, one needs to upload copies of PAN Card, Aadhar Card & a Cancelled Cheque (without signature). If someone does not upload the KYC documents, settlements to the partner Institute will not happen & shall be withheld. To start settlements to your bank account, we need your bank account details & your PAN details.

How to add Students?

Students can be added one-by-one or imported from an Excel file. Format of the Excel file can be found in the panel itself.

How many students can be added?

Unlimited. There is no limit on the number of students you can add or import.

Will I get an approval even if I apply on a holiday or beyond banking hours?

Yes! However, the KYC verification process might be impacted on holidays.

How will my students know about their login details?

Students will receive an SMS with their login details on their mobile phones immediately after their account is created in the system - either when you import student details in to the system or when you create their account individually.

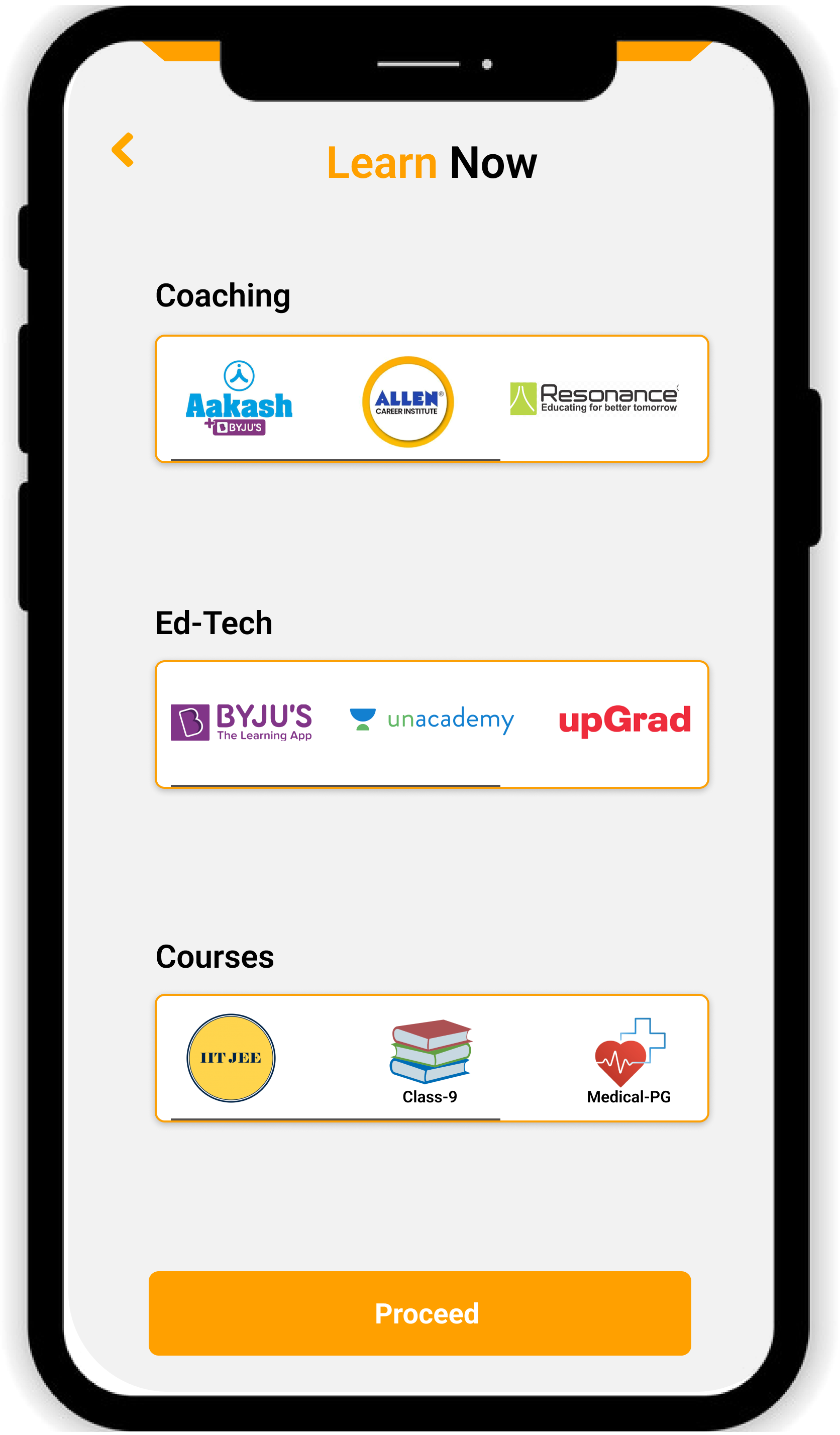

How many courses & programs can I add?

Unlimited. There is no limit on the number of Courses, Programs or Batches you can create.

Two of my Courses have the same fee structure. Do I need to enter the same data twice?

No. You can copy the fees structure & rename it as per your needs. You can also modify, add or remove fee heads if needed in the copied fees structure.

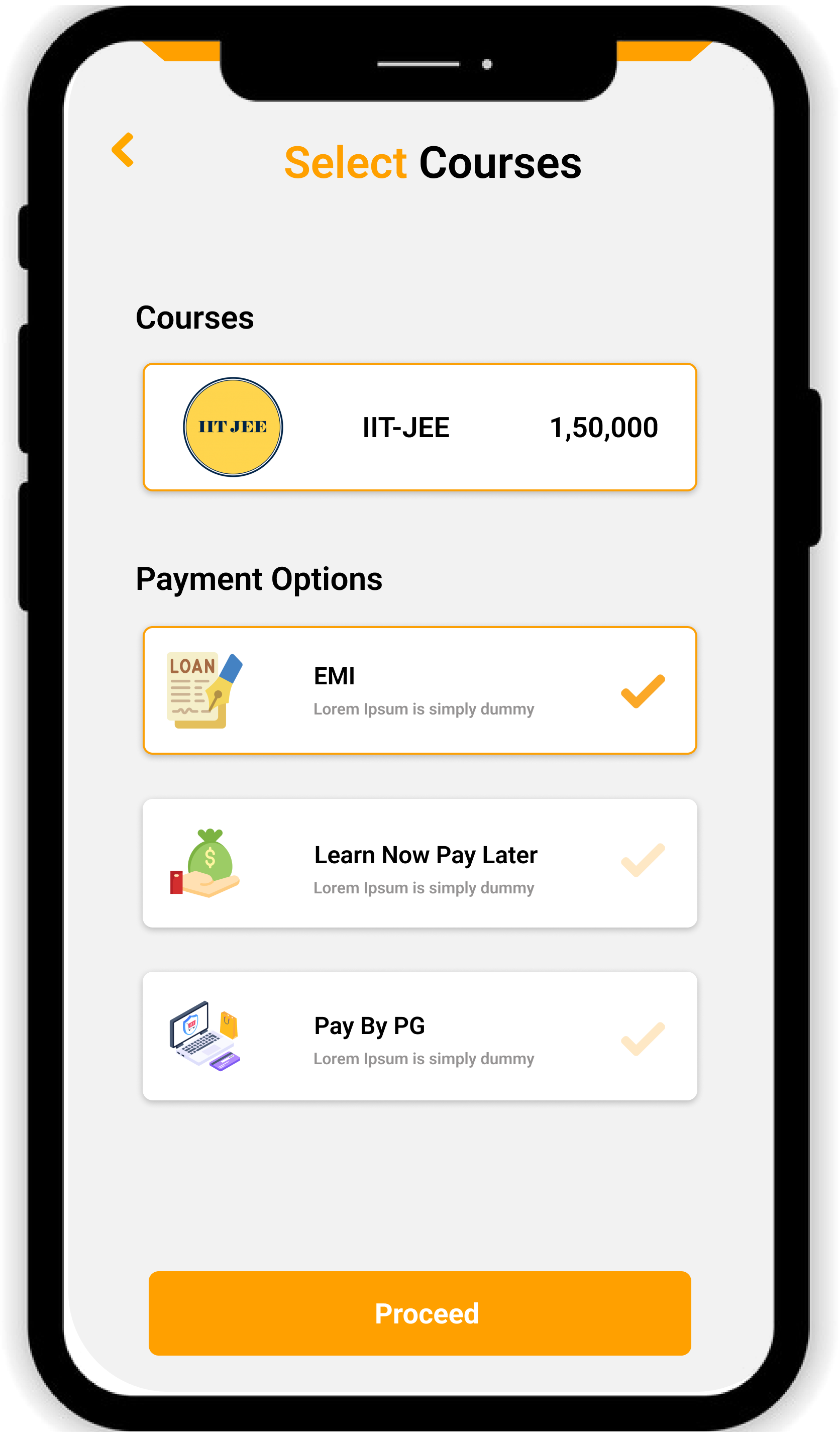

What are the different types of payment methods in which my students can pay?

Campusdunia supports & accepts payments from all major Credit & Debit Cards (VISA, MasterCard, RuPay, AMEX, Diners), Internet Banking (All major Indian Banks), Mobile Wallets* (Paytm, Mobikwik, JioMoney, etc.), UPI & Prepaid Cards. Campusdunia also supports acceptance of International payments.

Who is eligible to apply for CampusDunia?

Anyone who meets the following criteria can apply:

Resident of PAN India

Salaried employees and self-employed professionals like doctors, lawyers, shop owners, business owners etc with a minimum monthly salary of Rs. 20,000

* 21 years of age and above

Before you open the CampusDunia app, please have the following information handy:

Aadhaar Card

Pan Card

Bank statement of last statement